#Quickbook number

Explore tagged Tumblr posts

Text

0 notes

Text

QuickBooks Enterprise support phone number is an indispensable resource for businesses relying on this robust accounting software. Whether you face technical glitches, require guidance, or need personalized solutions, the support team is always ready to assist. By accessing this dedicated helpline, you ensure smooth accounting operations, improved efficiency, and seamless utilization of QuickBooks Enterprise's features.

1 note

·

View note

Text

Y’all

I am caught up at work.

✅ migrated us to Quickbooks, tidied everything, and done some stellar reporting along the way.

✅ 2025 budget that I’m not ashamed of.

✅ presented the first half of a report on Ned vs Tariffs vs The Roof. Second half involves loan numbers.

✅ giving statements

☑️Taxes

☑️Annual Report (with Power Point)

That is A LOT! I am getting it! It is going to be OKAY!

17 notes

·

View notes

Text

Simplify Business Finances with Accounting and Bookkeeping Services in Delhi

Running a business in a fast-moving city like Delhi? Then you already know how important it is to stay financially organized. That’s where Accounting and Bookkeeping Services in Delhi come in. Whether you're a freelancer, a startup founder, or managing a full-fledged company—these services help you keep everything from taxes to payroll in check.

Why Bother with Bookkeeping?

Honestly, bookkeeping and accounting aren't the most glamorous parts of running a business—but they’re critical.

Bookkeeping = recording transactions Accounting = analyzing financial health

When combined, they help you:

Understand your cash flow

Stay compliant with tax regulations

Avoid financial mistakes

Plan for the future

In a city as competitive as Delhi, this kind of financial clarity gives you an edge.

Benefits of Using Accounting and Bookkeeping Services in Delhi

Let’s be real—outsourcing your finances can be a game changer.

Save Time – No more late nights with spreadsheets

Stay Legal – GST and tax rules? Handled.

Get Expert Insights – Know exactly where your money is going

Focus on Growth – Let professionals handle the rest

Cost-Friendly – Way cheaper than building an in-house team

What’s Included in These Services?

When you sign up for Accounting and Bookkeeping Services in Delhi, here’s what you’re typically getting:

Day-to-Day Bookkeeping – Entries, reconciliations, ledgers

Accounting Reports – Profit & loss, cash flow, balance sheets

Tax Management – GST, TDS, income tax filings

Payroll – Salaries, compliance, payslips

Virtual CFO – Budgeting, forecasting, business planning

How to Choose the Right Service Provider in Delhi

Not all firms are the same. When looking for someone to trust with your business numbers:

Look for ICAI-certified accountants

Make sure they use good software (Zoho Books, Tally, QuickBooks)

Ask about experience with your industry

Transparency in pricing = a must

Best for Businesses Like...

E-commerce brands

Clinics and healthcare startups

Education platforms

Manufacturers

Tech companies and freelancers

Wrapping It Up

If you’re serious about taking control of your business finances, don’t try to juggle it all yourself. The right Accounting and Bookkeeping Services in Delhi can make all the difference—helping you stay on top of things, avoid penalties, and grow confidently.

3 notes

·

View notes

Text

1 note

·

View note

Text

I’m sure other people have said this but it’s SO funny this happened in cybersecurity. If it had been like. Idk teams or quickbooks or whatever it could have affected the same number of computers and been an understandable mistake. Your job is literally to prevent things like this from happening

7 notes

·

View notes

Text

the number of employers who require a strong knowledge of quickbooks and refuse to just train on it is kind of really irritating considering I went to 7 years of business school, 4 of them under an accounting curriculum because that was my original major, AND NO ONE FUCKING TAUGHT ME QUICKBOOKS

4 notes

·

View notes

Text

My boss is having me put together our annual report but i dont know how to make sense of the numbers on quickbooks nor do i know how to make pie charts and other common annual report features like theres templates on canva but theyre not really what im looking for. last year one of the board members put it together so why tf am i doing it this year. Like i genuinely have no idea what im supposed to be doing, at least have me work together w the board member or something wtfffff

2 notes

·

View notes

Text

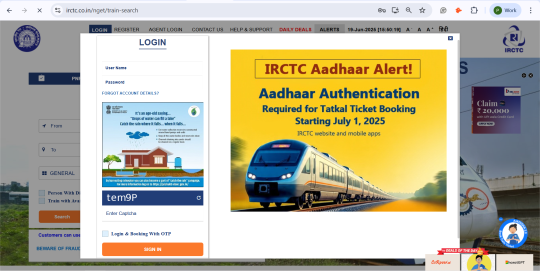

As Per the New Rule, How to Link Aadhaar with the IRCTC Account to Book Tatkal Tickets?

The Ministry of Railways has announced an important update for travellers. From 1st July 2025, Passengers who want to book their Tatkal tickets must have their Aadhaar verified on the official website of IRCTC.

This new rule of IRCTC ensures tight security and stops fraudulent bookings for a safe and secure journey for the genuine passengers.

While Tatkal train tickets are gone in just a few minutes, if you want your Tatkal booking faster, getting Aadhaar verified today is a smart move you can make. In this blog, you’ll be guided about:

New rule, and what do they mean?

How do you link your Aadhaar with your IRCTC profile?

Step-by-step to link Aadhaar Card

Answers to the most common questions about the latest update

Why did IRCTC make Aadhaar Linking Mandatory for Tatkal Ticket Booking System?

IRCTC has tightened Tatkal ticket booking rules to:

To reduce fake bookings & tout misuse

To speed up passenger verification

To allow passengers to pre-fill verified passenger details

Pre-Requisites

Before you proceed with linking your Aadhaar, you must have the following:

An active IRCTC account

Valid Aadhaar number

Mobile number linked to Aadhaar number

How to Link Aadhaar to IRCTC (Step-by-Step Guidance)

Step 1: Visit the Official Website of IRCTC www.irctc.co.in

Step 2: Go to the Menu on the top right corner.

Step 3: Click on “Log in”.

Step 4: Enter your username and login password. Enter the captcha shown below.

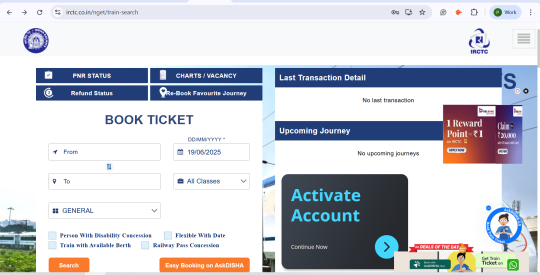

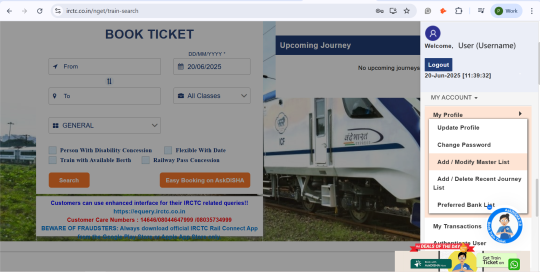

Step 5: Once you sign in, you will land on the home page. Now, click on the menu icon shown in the top right corner.

Step 6: Look for “Authenticate user” in “My Account” section.

Step 7: You will be redirected to the screen as shown below.

Step 8: Enter your 12-digit Aadhaar number. Here, your name must be written the same as on your Aadhaar Card.

Step 9: Click on “Verify Details and Receive OTP.” Note that you will only receive OTP when your name and your birthdate are matched using your aadhaar number.

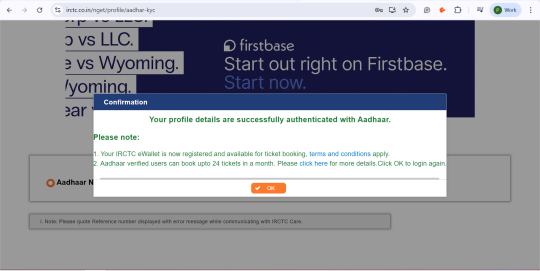

Step 10: Enter the OTP received on your device and click the checkbox below to confirm the details you have entered.

Step 11: Click on “Submit” and wait for confirmation.

How to Add Aadhaar-Verified Passengers to Your Account?

Step 1: Go to Menu > My Profile > Add/Delete Master List as shown below.

Step 2: You will be redirected to the screen shown below. Fill out the details and hit the “Submit” button.

Note: Having your master list ready in the IRCTC helps you get your tickets booked faster.

Top Tatkal Ticket Booking Tips for 2025

Log in 10–15 minutes early to avoid sudden logouts.

Use fast, stable internet while booking your tickets.

Make sure you are on mobile data for the added privacy of your data.

Pre-save payment methods and top up the IRCTC eWallet in advance.

Create and Aadhaar-verify your Master List for instant autofill.

Choose boarding or destination stations wisely for better seat availability.

Don’t waste time choosing berths. Select ‘Book’ if confirm berths are not available.

Prefer UPI or net banking over debit cards with slow OTP delivery.

Use the QuickBooks option if your Master List is set.

Stay calm, type accurately, and don’t refresh the payment page.

Frequently Asked Questions (FAQs): IRCTC Aadhaar Linking for Tatkal Booking System

Q. Is linking Aadhaar on IRCTC compulsory for Tatkal booking system in 2025?

A. It is not compulsory for all kinds of bookings. But, for Tatkal tickets, having Aadhaar-based verification is recommended for faster processing and to avoid last-minute errors.

Q. What if my Aadhaar is not linked to IRCTC?

A. You can still book tickets. Every time you wish to book tickets for you and your co-passengers, you will have to enter and verify manually each time, which can make the booking process longer.

Q. Can I book Tatkal tickets without linking Aadhaar?

A. Yes, it is possible.

Q. How many passengers can I add after linking Aadhaar?

A. A regular IRCTC account can add up to 6 passengers to the master list. If your account is Aadhaar verified, you can add up to 12 passengers.

Q. Will linking Aadhaar speed up Tatkal booking for sure?

A. Since passenger details are pre-verified. But practical speed still depends on your internet speed, payment method, and IRCTC server load. So stay prepared.

Final Thoughts

Being a citizen of India, Aadhaar-based verification is not optional, but a must-have if you wish to get your tickets booked hassle-free.This small step of Aadhaar verification is a step taken by IRCTC that enables genuine passengers to grab their Tatkal tickets without any unnecessary issues. So, don’t wait until the last minute! Link your Aadhaar today, understand the new booking flow, and travel stress-free tomorrow.

Source Link: IRCTC New Rules You Must Know Before Your Next Confirmed Train Ticket Booking

0 notes

Text

Unlock Financial Confidence with Financial Solutions Canada

In today’s complex business landscape, the right financial guidance is more than just a service—it’s a strategic advantage. At Financial Solutions Canada, we provide tailored financial solutions that go well beyond bookkeeping and tax filing, helping businesses nationwide navigate challenges with clarity, compliance, and confidence.

1. Personalized Accounting & Bookkeeping

Your business follows its own rhythm—seasonal sales, changing costs, varying cash flow. We tailor bookkeeping to your operations, ensuring accurate, up‑to‑date records. This offers real-time cash-flow insights, enabling smarter decisions and fewer surprises at year‑end.

2. Strategic Tax Planning & Compliance

Tax regulations are constantly shifting across provinces and federal levels. Our CPA‑led team develops strategic tax plans designed for your unique situation—whether you’re a small business or a high‑net‑worth individual. We ensure full compliance, maximize deductions, and structure your finances to minimize liabilities.

3. Industry‑Focused Financial Advice

A café in Vancouver and a tech startup in Toronto have vastly different financial needs. We deliver industry-specific services across retail, professional services, non‑profits, construction, and more—tailored to your sector's unique dynamics and goals.

4. Outsourced CFO & Advisory Services

Looking to grow without expanding your payroll? Our part‑time CFO services offer high-level financial guidance—budgeting, forecasting, capital allocation—so you can focus on scaling your business, not hiring full-time finance staff.

5. Digital Transformation & Cloud Adoption

The accounting world is going digital. We help you adopt and optimize cloud platforms like QuickBooks Online and Xero—handling setup, data migration, invoicing, payroll automation, and ongoing support. Gain scalable, secure, real‑time financial visibility.

6. Audit Support & Assurance Readiness

Facing a regulatory audit or investor due diligence? Our team helps you prepare clean, defensible records—organizing documentation, streamlining processes, and ensuring everything is presentation‑ready, reducing time, stress, and risk.

Why Choose Us?

Client‑Centric Approach No one-size-fits-all here. Reporting formats, advisory strategies, even communication styles are customized to your business and goals.

Technical Expertise with Personal Support You get the rigor of seasoned CPAs plus the accessibility of dedicated advisors—direct access, transparent communication, no red tape.

National Reach, Regional Know-How Whether you're dealing with Alberta payroll rules or Quebec tax credits, we've got you covered. Our team is grounded in local realities across Canada.

Tech‑Powered Efficiency We harness AI, automation, and cloud tools to cut manual effort, reduce errors, and improve transparency—ensuring your financial processes reflect modern efficiency.

Real Results. Real Growth.

Retail client: Improved invoicing and inventory tracking—30% fewer late payments.

Tech startup: CFO insights helped secure $250K in innovation funding and maintain flawless investor reports.

Hospitality business: Digital payroll overhaul cut processing time by 60% and simplified annual filings.

Ready to Elevate Your Finances?

At Financial Solutions Canada, we don’t just handle numbers—we empower businesses. Whether you're a solopreneur, mid‑size firm, or corporation, our customized solutions scale with you.

Book your strategy session today. Visit a2gsolutions.com/canadian-accounting-firms to get started.

Visit Now :

https://a2gsolutions.com/

0 notes

Text

How to Choose the Best CRM for Small Business Growth in the U.S.

Choosing the right Customer Relationship Management (CRM) system is a critical decision for any small business aiming to grow in today’s competitive market. With a growing number of options available, small businesses must strike the right balance between functionality, scalability, and cost-effectiveness. The good news is that Cloud CRM Solutions have made this decision more accessible, offering affordable, flexible tools to manage customer relationships effectively.

Learn more about CRM strategies tailored to SMBs at AeyeCRM.

Why CRM Matters for Small Businesses

CRM is not just a tool for enterprise giants anymore. Small businesses use CRM to:

Centralize customer data

Track sales and communication

Automate tasks like follow-ups and reporting

Improve marketing personalization

According to Salesforce, small businesses using CRM tools experience a 29% increase in sales and a 34% improvement in customer satisfaction. But the key is choosing a system that aligns with your business goals.

Key Considerations When Choosing a CRM

1. Business Size and Growth Goals

Is your business a solo operation, or do you have a growing team? The best CRM will grow with you. Cloud-based systems like Salesforce, Zoho, and HubSpot offer scalable plans that start small but can expand as your business grows.

2. Core Features You Actually Need

Avoid feature overload. Focus on:

Contact and lead management

Email integration

Pipeline tracking

Automation workflows

Custom dashboards

You can always add more features later through plug-ins or upgrades.

3. Integration with Other Tools

Many small businesses already use accounting tools, marketing platforms, or ERP systems. Look for a CRM that integrates seamlessly with tools like QuickBooks, Mailchimp, or NetSuite. Cloud ERP integration ensures data flows smoothly between your front and back-end systems.

4. Ease of Use and Support

A CRM system is only effective if your team actually uses it. Choose a platform with a clean interface and responsive support. Salesforce, for instance, is powerful but often requires professional setup. Partnering with a Salesforce consulting provider like AeyeCRM ensures correct configuration and faster adoption.

5. Mobile Access and Remote Work Support

Post-2020, flexibility is essential. Choose a CRM with strong mobile apps and cloud access so your team can work anywhere.

6. Budget and ROI Potential

Many CRMs offer free tiers but scale up based on users or features. Consider not just the monthly cost, but the time saved through automation and the sales gained through better tracking.

Top CRM Platforms for Small Businesses in the U.S.

Salesforce

Best for: Growing teams needing high customization

Pros: Powerful automation, integration, analytics

Cons: Steeper learning curve without expert setup

HubSpot

Best for: Startups looking for easy onboarding

Pros: Free tier, marketing tools built-in

Cons: Paid features can get expensive

Zoho CRM

Best for: Budget-conscious SMBs

Pros: Affordable, customizable, ERP-compatible

Cons: Interface may not feel as modern as others

Insightly

Best for: Project-based businesses

Pros: Integrated project management

Cons: Limited marketing features

Real-Life Example: Scaling With the Right CRM

A 15-person digital agency in California partnered with AeyeCRM to move from spreadsheets to a full Salesforce setup. The result? A 50% boost in sales efficiency and a 30% drop in missed follow-ups within 3 months. With help from AeyeCRM’s experts, they also enabled CRM implementation for SMBs that integrated with their invoicing and marketing platforms.

Signs You've Outgrown Your Current CRM

Your team is still using spreadsheets

You can't segment or personalize emails easily

Reporting takes hours instead of minutes

You have no automation for sales or marketing

If these sound familiar, it's time to level up with a proper Cloud CRM Solution.

Frequently Asked Questions (FAQs

What is the best CRM for a small business in the U.S.?

It depends on your needs. Salesforce is great for growth and customization, HubSpot is ideal for simplicity, and Zoho is excellent for cost-conscious businesses.

Can I integrate my CRM with my accounting or ERP tools?

Yes. Most cloud CRMs offer integrations with platforms like NetSuite, QuickBooks, and others. This is where Cloud ERP integration adds major value.

How much does a small business CRM cost?

Pricing varies from free (HubSpot starter tier) to $25-$150/month per user, depending on features and scale.

Do I need help to set up Salesforce for my small business?

Yes, especially if you want a streamlined and customized experience. That’s where Salesforce consulting services from AeyeCRM can help.

How long does CRM implementation take?

Basic setup can take a few days, while more complex configurations and integrations can take 4-8 weeks, especially with CRM implementation for SMBs.

Conclusion

Choosing the best CRM for your small business doesn’t mean choosing the most expensive or most feature-packed option. It means selecting the right tool that fits your current needs while supporting your growth. Whether you’re leaning toward Salesforce, HubSpot, or Zoho, the success of your CRM depends on proper planning, training, and support.

Contact us today to explore tailored CRM and cloud integration solutions.

0 notes

Text

Smarter Numbers, Less Stress: How AI Bookkeeping Is Changing the Game for Small Businesses

Managing books isn’t just about numbers—it’s about peace of mind. For small business owners and freelancers, balancing income, expenses, taxes, and payroll can feel overwhelming. That’s where AI bookkeeping comes in—not as a replacement for accountants, but as a powerful tool that simplifies your financial life and saves hours of manual work.

If you’ve ever wished for a system that just handles the books, it’s time to understand what AI bookkeeping can actually do—and how it’s revolutionizing the way businesses stay organized and compliant.

What is AI Bookkeeping?

AI bookkeeping uses artificial intelligence to automate and streamline accounting tasks like data entry, expense tracking, invoice categorization, and financial reporting. It works behind the scenes reading receipts, matching transactions, reconciling bank statements, and even spotting errors before you do.

Instead of spending hours on spreadsheets or paying for reactive accounting, AI bookkeeping gives you a real-time snapshot of your business finances.

Why Small Business Owners Are Making the Switch

Time-Saving Automation

No more chasing receipts or updating ledgers line by line. AI systems pull data directly from your bank, POS, or payment platforms and categorize it instantly.

Fewer Mistakes

Let’s face it—humans make errors, especially when multitasking. AI bookkeeping reduces manual entry mistakes and flags unusual transactions so nothing slips through the cracks.

Cost-Effective Growth

Hiring a full-time bookkeeper can be expensive. AI bookkeeping platforms are scalable and affordable, making them ideal for startups and growing businesses.

Real-Time Insights

AI tools offer dashboards that show your cash flow, income, and expenses—updated daily. This helps you make smarter financial decisions and avoid surprises during tax season.

Stress-Free Tax Prep

AI keeps everything organized, categorized, and audit-ready. When it’s time to file taxes, your accountant has everything they need—clean, accurate, and compliant.

Who Can Benefit from AI Bookkeeping?

Freelancers juggling multiple income sources

E-commerce stores with high transaction volume

Restaurants and cafés with complex daily sales

Consultants who need to track billable hours and expenses

Nonprofits managing donations and grants

If you’re tired of feeling behind or unsure about your books, AI bookkeeping can give you clarity and control.

AI + Human = The Perfect Pair

AI powered bookkeeping doesn’t eliminate the need for accountants—it empowers them. Instead of spending time cleaning up spreadsheets, your accountant can focus on strategy, tax planning, and growth. Think of AI as your digital assistant and your accountant as the trusted advisor.

Choosing the Right AI Bookkeeping Platform

When choosing an AI bookkeeping tool, look for:

Bank-level security

Seamless integration with your bank, CRM, or POS

User-friendly dashboards

Live support or accountant access

Transparent pricing

Popular tools include QuickBooks Online with AI features, Xero, FreshBooks, and newer AI-driven platforms like Bench and Botkeeper.

Final Thoughts

AI bookkeeping is not a trend—it’s the new standard. Whether you’re a solo entrepreneur or scaling your team, automating your books is one of the smartest decisions you can make. You’ll save time, reduce stress, and gain real clarity on your business health.

Start small, stay consistent, and let AI do the heavy lifting. Your future self—and your bottom line will thank you.

0 notes

Text

Why More Businesses Are Choosing Accounting Outsourcing Companies in India

Managing your company's finances takes more than just number crunching — it requires precision, expertise, and the right tools. That’s why an increasing number of businesses across the globe are turning to accounting outsourcing companies in India. These firms offer a perfect blend of skilled manpower, advanced technology, and cost-efficiency to help organizations handle their financial operations more effectively.

India has earned a solid reputation as a trusted outsourcing destination. With highly qualified professionals and services that align with global accounting standards like IFRS and GAAP, Indian accounting firms provide dependable support across various financial functions.

Key Reasons to Outsource Accounting to India

Here’s why outsourcing your accounting functions to India is a smart move:

Affordable Services Save up to 70% on operational costs by outsourcing to India compared to maintaining in-house finance departments in the West.

Access to Financial Experts Work with certified professionals such as Chartered Accountants, CPAs, and tax consultants.

Use of Latest Software Indian firms are proficient with tools like QuickBooks, Xero, Zoho Books, SAP, and Tally.

Data Security Top companies comply with ISO and GDPR standards, ensuring the safety and confidentiality of your financial data.

Strategic Focus Outsourcing frees up internal teams so you can focus on growing your core business.

Services Offered by Indian Outsourcing Firms

The range of services provided is comprehensive and customizable:

Bookkeeping and financial record management

Payroll processing and compliance

Accounts payable and receivable

Tax filing (Income Tax, GST, TDS)

Financial reporting and analytics

Budgeting and cash flow forecasting

Year-end audit support

Industries That Rely on Accounting Outsourcing

Indian firms serve clients from a wide array of sectors, including:

IT and Software Development

Retail and E-commerce

Real Estate and Construction

Healthcare and Life Sciences

Manufacturing and Supply Chain

Travel, Hospitality, and Entertainment

Tips for Choosing the Right Outsourcing Company

Before you commit to any provider, keep these tips in mind:

Check their client portfolio and domain expertise

Ask about the technology stack they use

Ensure strong data protection policies are in place

Look for flexible pricing models and transparent processes

Read client testimonials or ask for case studies

What’s the Future of Accounting Outsourcing in India?

India’s accounting industry is rapidly evolving with the integration of AI, machine learning, and cloud technologies. These tools are helping outsourcing companies deliver real-time insights, faster reporting, and more accurate financial forecasting. This evolution only strengthens India's position as a global leader in outsourced finance and accounting services.

FAQs

Q: Why are Indian accounting outsourcing companies so popular? They combine expert knowledge, modern tech, and lower costs—making them ideal partners for global businesses.

Q: Will my financial data be safe? Yes, most firms follow strict data protection protocols and compliance standards.

Q: Are Indian firms trained in international accounting standards? Absolutely. Professionals in India are well-versed in IFRS, GAAP, and even US taxation systems.

Q: Can I outsource only a part of my accounting work? Yes. Most services are scalable and customizable to fit your business needs.

Final Thought

Whether you’re a startup or a large enterprise, teaming up with accounting outsourcing companies in India can help you save time, reduce costs, and ensure that your finances are handled professionally. The right partner will offer you peace of mind and a stronger foundation for business growth

1 note

·

View note

Text

5 Signs It's Time to Rethink Your Business Accounting Services

Running a small business is hard enough. Between keeping customers happy, managing staff, and planning for growth, who has time to chase numbers or double-check spreadsheets every week?

Here’s a question worth asking: Are your current accounting tools actually helping—or just holding you back?

Many small business owners find themselves stuck with outdated or overly complicated systems. And when those systems start costing time, money, or peace of mind, it’s a sign that something’s got to change. Modern Accounting Services offers more than just number-crunching—they streamline invoicing, payments, and payroll so owners can focus on what really matters: running the business.

When It All Feels Like Too Much

Let’s be honest. Traditional accounting setups often come with a heavy load—manual data entry, juggling between apps, or relying on software that feels like it belonged in 2008. Mistakes creep in, updates get missed, and things slip through the cracks. That kind of stress builds up fast, especially when there’s no clear picture of cash flow or upcoming expenses.

That’s where smarter, simpler tools come in. With platforms like Zil Money, small business owners gain a streamlined way to manage finances from a single, secure space. It’s user-friendly, works across devices, and is built to cut down the chaos that outdated accounting tools leave behind.

Sign #1: You are Still Chasing Invoices

The Problem: Clients take forever to pay, and you are stuck sending awkward reminder emails week after week.

The Fix: With Zil Money’s integrated invoicing system, businesses can create and send invoices instantly—by email or SMS. Payment tracking shows exactly when invoices are opened, paid, or overdue, which helps keep cash flow predictable and reduces delays.

Sign #2: Payroll Days Take All Day

The Problem: Running payroll is a full-day job that eats into productivity. Calculations, checks, and errors add unnecessary stress.

The Fix: Print payroll checks in batches or handle direct payments from a single dashboard. Zil Money makes it easy to manage wages—especially for businesses with part-time or seasonal staff—while keeping everything compliant and organized.

Sign #3: You are Drowning in Logins and Spreadsheets

The Problem: You are flipping between tools—one for payroll, another for bills, a third for accounting—and your desktop looks like a cluttered puzzle.

The Fix: Zil Money connects with QuickBooks, Zoho, and Gusto, so everything syncs automatically. Invoices, payments, and reports are managed on one unified platform, reducing errors and saving time.

Sign #4: You are Always Double-Checking for Errors

The Problem: Every dollar that goes in or out has to be triple-checked. One mistake can throw off the books or delay vendor payments.

The Fix: All transactions, whether it’s paying a bill or issuing a refund, are stored and monitored in one high-security dashboard. Payments are traceable, and all records are automatically updated—making it easier to stay accurate and audit-ready.

Sign #5: You Can’t Work on the Go

The Problem: You are out of the office and can’t access your accounting tools—so tasks pile up until you're back at your desk.

The Fix: Zil Money works across Windows, Mac, Android, and iOS. Whether on a tablet during a lunch meeting or from a laptop at home, business owners can keep tabs on their finances in real time. The interface stays consistent across devices for a smooth experience every time.

A Better Way to Look at Business Finance

There’s a shift happening in how small businesses manage their money. Instead of outsourcing everything or using clunky systems that complicate daily operations, more business owners are opting for flexible platforms that do it all under one roof.

It’s not just about having access to data—it’s about having control. Better Accounting Services empower owners to make informed decisions, spot cash flow issues early, and stay ahead of deadlines without burnout. It’s a way to take ownership of the financial side of the business without feeling buried under it.

This kind of shift doesn't just save time—it builds confidence. With smoother systems in place, teams run better, vendors get paid faster, and growth doesn’t feel like guesswork. Technology can’t replace good business sense, but it can make running a business a lot less stressful.

Ready to Stop Stressing Over Spreadsheets?

Whether it’s missed payments, long payroll days, or too many tabs open—there’s a better way to manage business finances. Smarter accounting isn’t about doing more work. It’s about doing the right work more easily.

Explore what modern Accounting Services can do for your business—simplify, streamline, and take back control with Zil Money.

0 notes

Text

Unleashing the Power of QuickBooks Enterprise Support for Seamless Business Management

Introduction

In today's rapidly evolving business landscape, efficient financial management plays a critical role in the success of any organization. QuickBooks Enterprise Support, a powerful accounting software solution, has emerged as a cornerstone for businesses aiming to streamline their financial processes. However, even the most robust software can encounter challenges or require assistance at times. This is where QuickBooks Enterprise Support steps in, providing businesses with the expertise and guidance they need to make the most of their software investment.

Understanding QuickBooks Enterprise Support

QuickBooks Enterprise Support is a comprehensive service offered by Intuit, the company behind QuickBooks. It is designed to assist businesses in effectively utilizing the capabilities of QuickBooks Enterprise and overcoming any hurdles they might encounter during its implementation or usage. This support comes in various forms, including live chat, phone support, community forums, and online resources. With a team of knowledgeable experts, QuickBooks Enterprise Support ensures that businesses can optimize their software for seamless financial management.

Key Features and Benefits

Technical Assistance:

QuickBooks Enterprise Support provides technical assistance to troubleshoot any software-related issues. Whether it's installation, software updates, or connectivity problems, the support team is equipped to guide businesses through the resolution process.

Customized Solutions:

Every business has its own unique requirements and challenges. QuickBooks Enterprise Support offers tailored solutions based on the specific needs of a business, ensuring that the software is configured to meet those needs effectively.

Data Migration:

Transitioning from another accounting system to QuickBooks Enterprise can be complex. The support team assists in smooth data migration, ensuring that crucial financial data is accurately transferred without any loss.

User Training:

A powerful software is only as effective as the users who operate it. QuickBooks Enterprise Support provides training resources to empower users with the knowledge and skills needed to navigate the software efficiently.

Continuous Updates:

QuickBooks Enterprise is regularly updated with new features and enhancements. The support team keeps businesses informed about these updates and guides them on how to leverage the latest functionalities.

Security and Data Integrity:

Ensuring the security of financial data is paramount. QuickBooks Enterprise Support helps businesses set up security measures and offers guidance on best practices to safeguard sensitive information.

Dedicated Expertise:

Whether it's a technical glitch or a question about accounting practices, QuickBooks Enterprise Support connects businesses with experts who specialize in both the software and accounting principles.

24/7 Accessibility:

Technical issues can arise at any time. QuickBooks Enterprise Support offers round-the-clock assistance, ensuring that businesses can get help whenever they need it.

Realizing Seamless Business Management

Effective utilization of QuickBooks Enterprise Support can significantly impact a business's financial management practices. Here's how:

Time and Resource Savings:

Trying to troubleshoot technical issues on your own can be time-consuming and frustrating. With QuickBooks Enterprise Support, businesses can resolve problems swiftly, allowing them to focus on core operations rather than getting bogged down by software issues.

Enhanced Productivity:

QuickBooks Enterprise offers an array of advanced features designed to streamline various financial processes. By utilizing support resources, businesses can maximize productivity by harnessing these features effectively.

Accurate Financial Insights:

QuickBooks Enterprise is a treasure trove of financial data. With the guidance of support experts, businesses can generate accurate reports, analyze trends, and make informed decisions based on real-time data.

Scalability:

As businesses grow, their financial requirements evolve as well. QuickBooks Enterprise Support assists in configuring the software to accommodate increasing complexities, ensuring that it scales alongside the organization.

Regulatory Compliance:

Adhering to financial regulations and tax requirements is non-negotiable. QuickBooks Enterprise Support helps businesses set up their software in compliance with these regulations, reducing the risk of penalties.

Confidence in Financial Operations:

With a team of experts at their disposal, businesses can confidently navigate the intricacies of financial management. This assurance is invaluable, especially in times of audits or critical financial decisions.

Conclusion

QuickBooks Enterprise Support is not just a troubleshooting service; it's a strategic resource that empowers businesses to harness the full potential of their accounting software. In an era where data-driven decision-making is paramount, having a reliable support system can make all the difference. Whether it's technical assistance, tailored solutions, or user training, QuickBooks Enterprise Support ensures that businesses can navigate the complexities of financial management with confidence and competence. By leveraging this support, businesses can streamline their operations, drive growth, and stay ahead in the dynamic business landscape.

#quickbooks enterprise#QuickBooks Enterprise Support#Quickbooks#Quickbooks enterprise support number

0 notes